Learn Technicals: Candlestick Chart Patterns

- Finquity+

- May 14, 2020

- 5 min read

The next installment in the beginner's guide to learn technical analysis is all about the types of candlestick patterns. The previous blog took you on a tour of various types of charts used in technical analysis. It is now well established that candlestick charts are the most used charts in technical analysis, hence getting a detailed view of the same is necessary.

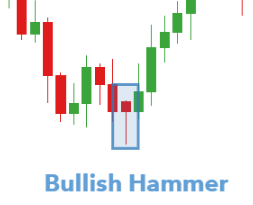

Hammer Pattern

Recalling the hammer candlestick from the previous blog, a pattern that has a hammer candlestick is known as a hammer pattern. Such a pattern can be seen when the bears are about to end and the market is going to see a potential uptrend. Hence, in other words, a hammer pattern gives confirmation for reversal, irrespective of the candle being green or red.

Theoretically, the size of the wick is at least 2 times the body.

There should be a very small or no upper wick to the candle.

Although color does not make much of a difference, a green hammer is more powerful and gives a strong confirmation for reversal

High volumes are not a requirement for the candle, but if present would also put confidence in the reversal pattern.

Pattern Psychology

As seen in the chart, the market had been in a downward trend and hence, the price starts to fall down after opening. However, the market is not able to sustain this fall and the price has risen again.

This creates small bodies with long wicks to indicated that the bulls have entered the market and the bears have not sustained.

If the next candle opens higher, then it would provide a perfect confirmation of a reversal trend.

Here is a live example from Avanti Feeds

Hammer low is at Rs. 270 which can also be the stop loss.

On buying the share on the next day, after receiving a confirmation of growth at Rs 280-285, it gave a return of almost 35% within a week's time.

Morning Star Pattern

Morning Star is another bullish reversal pattern made up of three candlesticks. It occurs in a downtrend and indicates that the bulls are about to enter the market.

The first candle has a long body and is red in color.

The market either gaps down or remains at the same price in the next candle to make a small body and a long wick (confused candlestick).

In this case, as well, the color doesn't make a difference however, a green candle provides a powerful confirmation.

The next candle opens higher with greater volumes. In reversals, volumes play a vital role.

Pattern Psychology

The market has been in a downtrend and there is a bearish sentiment, however, the bulls have started entering the market making the next Doji Candle. This indicates the bears may not sustain in the market.

The longer the wicks of the candle with a small body more are the chances of a strong reversal.

Bulls enter in the next candle seeing the trend and takes the price up with higher volumes. If these levels are sustained there is a confirmation and the sentiments change from bearish to bullish.

Here is an example:

After a stop loss of Rs 600 at the low of the small body candle, on buying the share on getting the confirmation at Rs 615, the stock prices rallied up following a morning star pattern.

Evening Star Pattern

Evening Star is the opposite of the morning star pattern and also is a 3 candle pattern. It indicates an end in the uptrend and marks the peak of it.

The first candle is always a green candle with a long body.

The market either gaps up or remains at the same price in the next candle to make a small body and a long wick (confused candlestick).

However, in this case, a red candle is considered a more powerful indicator of a trend reversal.

The following candle needs to confirm the reversal in the trend with a gap down or a full-body red candle with high selling volumes.

Pattern Psychology

The market has been in an uptrend and there is a bullish sentiment, however, the bears have started entering the market making the next Doji Candle. This indicates the bulls may not sustain in the market.

The longer the wicks of the candle with a small body more are the chances of a strong reversal.

Bears enter in the next candle seeing the trend and takes the price down with higher volumes. If these levels are sustained there is a confirmation and the sentiments change from bullish to bearish.

Example,

The chart has seen a downtrend after making an evening star pattern giving a sell indication.

Seeing the heavy volumes on the day after the small body red candle was made, a reversal was confirmed and a sell would save you a loss of at least 10% from that point.

Bullish Engulfing Pattern

A Bullish Engulfing Pattern is a 2 candle pattern wherein a green full-body candle engulfs its preceding red candle while the share suffered a downtrend.

The candlestick body of the previous red candle is completely covered by the next sessions green full-body candle.

The engulfing candle should be a full-body green candle and not a Doji or Hammer one to ensure a reversal.

Higher volumes with such a trend is always a cherry on the cake.

Pattern Psychology

After a decline in the prices, the prices open even lower than the previous session's close, however, before the close of the sessions buyers flood the market taking the market higher than the previous session's open.

The sudden change in sentiments combined by heavy volumes changes the trend and hence this pattern has proven to be very effective giving consistent results.

An example of a bullish pattern is shown by Escorts in the given chart

The stock gave a return of 15-17% after witnessing a Bullish Engulfing pattern.

Bearish Engulfing Pattern

Similar to a Bullish Engulfing pattern this is also a 2 pattern candle formed at the end of an uptrend in which a red full-body candle engulfs the previous green candle. This shows that the buyers have been absorbed by the sellers.

The body of the previous red candle has been completely covered by the red full-body candle.

The candle should only be a full-body red candle and not a Doji or Hammer one

Larger volumes give a strong confirmation of trend reversal.

Pattern Psychology

After an increase in the prices, the prices open even higher than the previous session's close, however, before the close of the sessions sellers flood the market taking the market lower than the previous session's open.

The sudden change in sentiments combined by heavy volumes changes the trend and hence this pattern has proven to be very effective giving consistent results.

An example,

The above chart shows a perfect bearish engulfing pattern.

Selling at the end of the day during the red candle would help you save a loss of Rs 182 per share.

This brings us to the end of this blog. However, these are just names of a few strong patterns, having a better understanding of how a candle works always help you detect patterns on your own to predict an uptrend or a downtrend.

This blog definitely educated us with the points at which the market is going to witness a reversal, however, is the market going to sustain such a reversal? If yes, for how long? Such questions are answered by studying the support and resistance levels of the stock.

Stay tuned to Finquity+ to get a detailed answer to these questions!

Get access to actual images from the google drive link. Click here!

Comments